Cheboygan, Mi Renters Insurance Quotes

Did you know that nearly 60% of renters in Cheboygan, MI, don’t carry renters insurance? This statistic highlights a significant gap in protection that could leave you vulnerable. Understanding the various coverage options available is crucial, as it can safeguard your personal belongings and provide liability protection. As you compare quotes from local providers, you’ll discover factors that can significantly impact your premiums. The choices you make now could save you money in the long run, but what’s the best approach to finding the right coverage for your needs?

Importance of Renters Insurance

When you rent a home, you might think your landlord’s insurance covers everything, but that’s not the case.

You’re responsible for your belongings, and many policy exclusions could leave you vulnerable. Without renters insurance, you risk losing personal items without compensation.

Protect your freedom and reduce your renter responsibilities by investing in a policy that fills those gaps and safeguards your assets.

Coverage Options Available

Understanding your renters insurance options is crucial for protecting your belongings.

You’ll want to consider personal property coverage, which safeguards your items against theft or damage.

Additionally, liability coverage is essential for protecting yourself from legal claims.

How to Compare Quotes

When comparing renters insurance quotes, start by understanding the coverage options each policy offers to ensure you’re fully protected.

Next, assess the deductibles and premiums to find a balance that fits your budget.

Don’t forget to evaluate any available discounts that could save you money on your policy.

Understand Coverage Options

Navigating the world of renters insurance can feel overwhelming, but grasping your coverage options is crucial for making informed decisions.

Focus on personal property protection, liability coverage, and tenant responsibilities. Be aware of policy exclusions and coverage limits.

Understand the claim process and potential premium adjustments. Also, consider additional living expenses in your rental agreements to safeguard your personal belongings effectively.

Assess Deductibles and Premiums

After you’ve grasped your coverage options, it’s time to assess deductibles and premiums to ensure you’re getting the best deal.

Compare deductible types—higher deductibles typically mean lower premiums.

Analyze premium factors such as location, credit score, and claims history.

Evaluate Discounts Available

Discounts can significantly lower your renters insurance premium, making it essential to evaluate what’s available.

Check for discount eligibility based on factors like bundling policies, security systems, or claims history.

When you conduct policy comparisons, focus on how these discounts impact your overall costs.

Taking the time to explore these options ensures you get the best coverage at a price that respects your freedom.

Factors Affecting Premiums

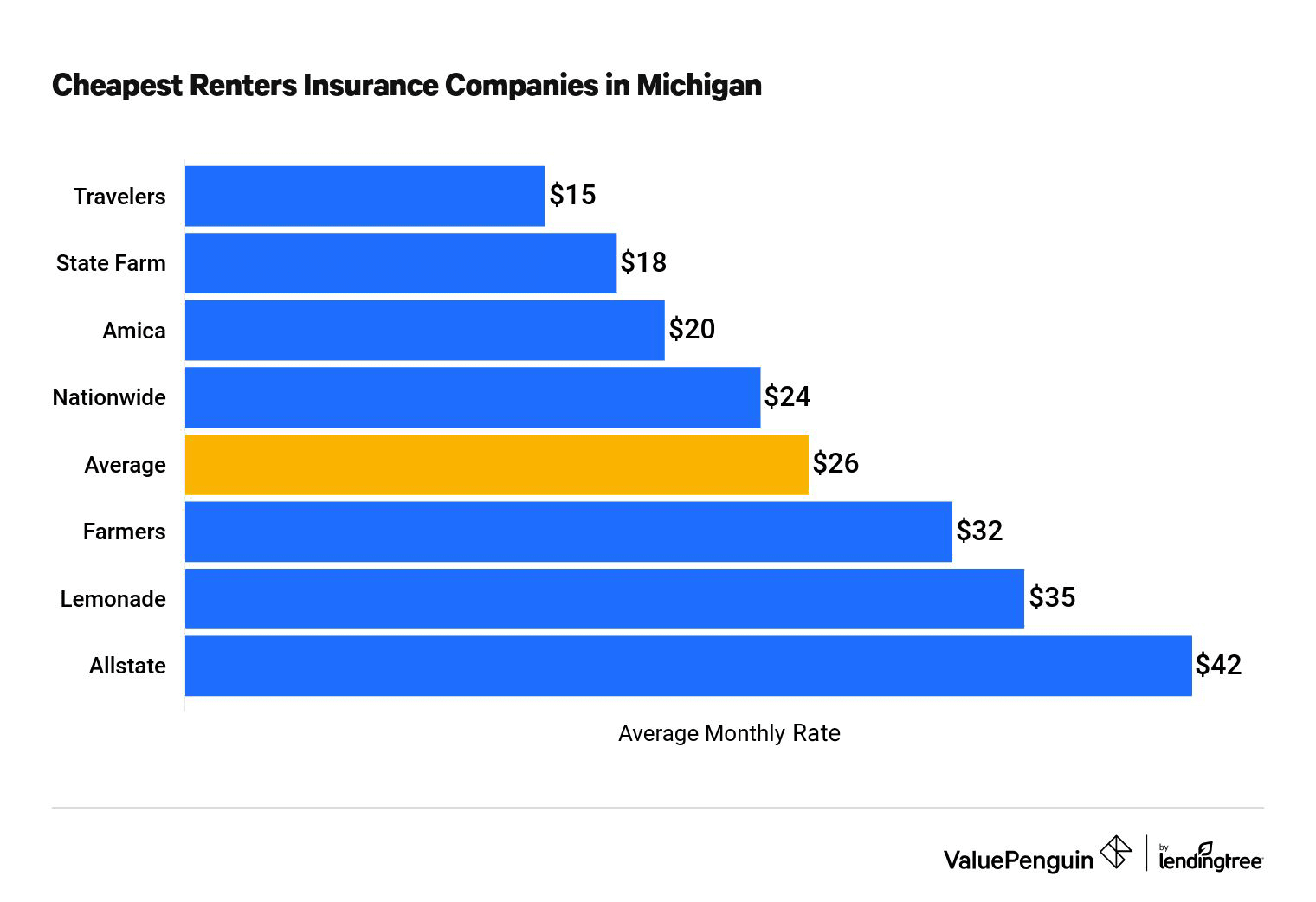

Several key factors can significantly impact your renters insurance premiums in Cheboygan, MI.

Your location, the value of your belongings, and your claims history act as premium influences.

Insurers conduct a risk assessment based on these elements, determining how likely you’re to file a claim.

Top Insurance Providers in Cheboygan

When searching for renters insurance in Cheboygan, you’ll want to consider the top providers that can best meet your needs.

Look for local insurance companies renowned for their reliability and excellent customer service.

Reading customer reviews can help you gauge their reputation and satisfaction levels.

Choosing the right provider ensures you have the freedom and peace of mind you deserve while renting.

Read Also: Luling, La Renters Insurance Quotes

Tips for Lowering Costs

If you want to save on renters insurance, consider increasing your deductible amount; this can significantly lower your premium.

Bundling your renters policy with other insurance, like auto or life, can also lead to substantial discounts.

Increase Deductible Amount

Raising your deductible amount can be a smart move to help lower your renters insurance costs in Cheboygan.

By implementing deductible strategies, you can significantly reduce your premiums.

Consider the deductible impact on your budget; a higher deductible means lower monthly payments, but ensure you’re comfortable paying it in case of a claim.

Choose wisely, and enjoy the freedom of lower costs!

Bundle Insurance Policies

One effective way to lower your renters insurance costs in Cheboygan is to bundle your insurance policies.

By combining your renters insurance with auto or life insurance, you can take advantage of policy bundling, which often leads to significant insurance savings.

This strategy not only simplifies your coverage but also frees up your budget for the things you truly enjoy.

Frequently Asked Questions

What Is the Average Cost of Renters Insurance in Cheboygan?

The average cost of renters insurance typically ranges from $15 to $30 monthly. By exploring diverse coverage options, you can find premiums that suit your budget while ensuring your belongings are adequately protected. Don’t wait—get covered today!

Do I Need Renters Insurance if I Live With Family?

Even if you live with family, you should consider renters insurance. It provides family coverage and protects against shared liability. You deserve peace of mind knowing your belongings are safeguarded, no matter where you live.

Can I Get Renters Insurance Without a Credit Check?

You can often get renters insurance without a credit check, but options may vary. Look for providers that offer flexible policy options. Enjoy peace of mind with renters insurance benefits, safeguarding your belongings without compromising your freedom.

How Do Claims Work With Renters Insurance?

When you file a claim, you’ll go through the claims process, which varies by insurance provider. Common claim types include theft, fire, or water damage. Understanding this helps you navigate the situation confidently and swiftly.

Are There Discounts Available for Renters Insurance in Cheboygan?

You can often find discounts on renters insurance by checking your discount eligibility. Comparing policies from different providers helps uncover savings, ensuring you get the best deal while enjoying the freedom of your choice.

Read Also: Ravenna, Oh Renters Insurance Quotes

Conclusion

In Cheboygan, don’t leave your belongings to chance—investing in renters insurance is like putting a safety net under your life. By understanding your coverage options and comparing quotes, you can find a policy that fits both your needs and budget. Remember, the right protection not only shields your possessions but also grants you peace of mind. So, take the leap and secure your home today; it’s a small price for a shield against the unexpected.